Life Insurance in and around Layton

State Farm can help insure you and your loved ones

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Layton

- Kaysville

- Farmington

- Syracuse

- Clearfield

- Clinton

- Ogden

- Fruit Heights

- Bountiful

- North Salt Lake

- Salt Lake

- Hill Air Force Base

- South Ogden

- North Ogden

- Pleasant View

Your Life Insurance Search Is Over

The standard cost of funerals in this day and age is around $8,300, according a recent study by the National Funeral Directors Association. Unfortunately, it may be difficult for your family to pay for your funeral as they grieve. That's where Life insurance with State Farm comes in. Having the right coverage can help the people you love afford funeral arrangements and not end up with large debts.

State Farm can help insure you and your loved ones

Life happens. Don't wait.

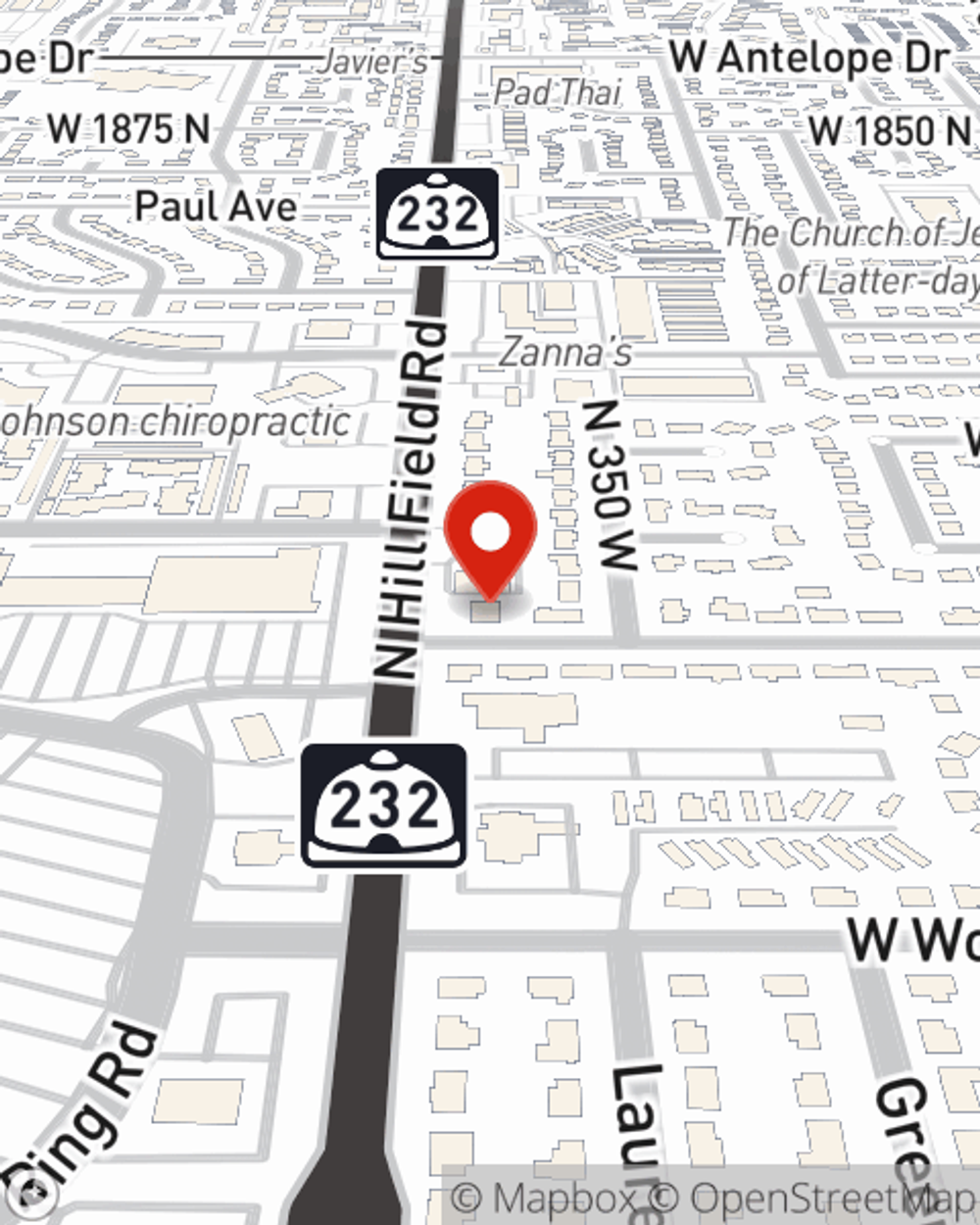

Agent Jason Oyler, At Your Service

Fortunately, State Farm offers many coverage options that can be adjusted to match the needs of those most important to you and their unique situation. Agent Jason Oyler has the deep commitment and service you're looking for to help you pick a policy which can support your loved ones in the wake of loss.

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to explore what a company that processes nearly forty thousand claims each day can do for you? Reach out to State Farm Agent Jason Oyler today.

Have More Questions About Life Insurance?

Call Jason at (801) 546-6108 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Jason Oyler

State Farm® Insurance AgentSimple Insights®

Estate planning: Understanding the basics

Estate planning: Understanding the basics

An estate plan does more than just offer direction for assets. Estate planning can help others execute your wishes and take care of those you love.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.