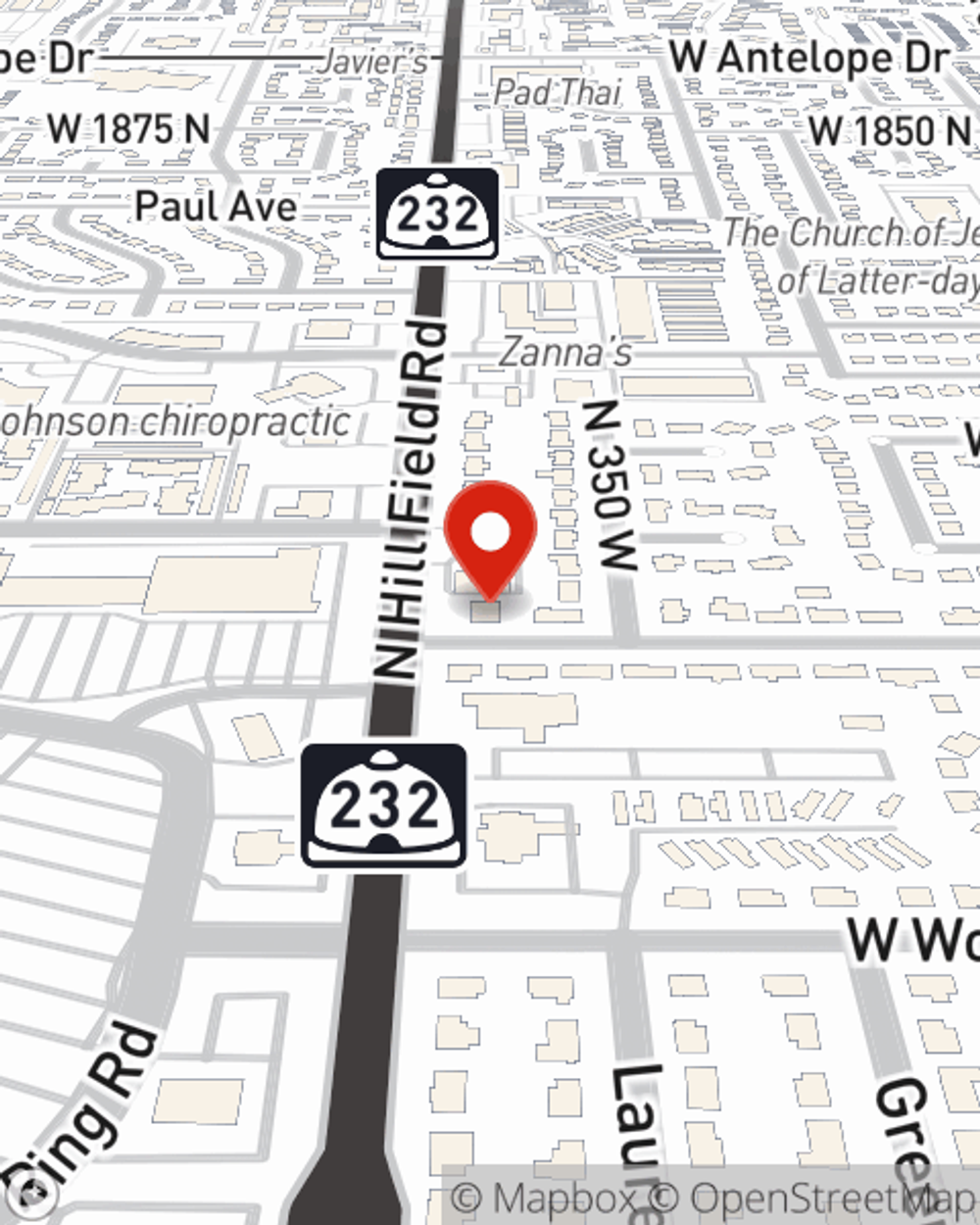

Auto Insurance in and around Layton

Layton! Are you ready to hit the road with auto insurance from State Farm?

Take this route for your insurance needs

Would you like to create a personalized auto quote?

- Layton

- Kaysville

- Farmington

- Syracuse

- Clearfield

- Clinton

- Ogden

- Fruit Heights

- Bountiful

- North Salt Lake

- Salt Lake

- Hill Air Force Base

- South Ogden

- North Ogden

- Pleasant View

You've Got Places To Be. Let Us Help!

Why choose Jason Oyler to insure your vehicle? You want an agent who is not only a resource in the field, but is also a reliable associate. With State Farm, Layton drivers can enjoy coverage options personalized for their specific needs, all backed by a top provider of auto insurance.

Layton! Are you ready to hit the road with auto insurance from State Farm?

Take this route for your insurance needs

Protect Your Ride

State Farm offers flexible reliable coverage with a variety of savings options available. You could sign up for Drive Safe & Save™ for savings up to 30%. Then there's the Steer Clear and Good Student Discounts that offer savings until you turn 25. And Vehicle Safety Features applies if your vehicle has an alarm or some other anti-theft device to deter crime. These are a few of the savings options State Farm offers! Most State Farm customers are eligible for one or more savings option. Jason Oyler can explain which ones you qualify for to make a policy for your unique needs.

This can include coverage for a variety of situations and vehicles, too, like rental car coverage, antique or classic cars or electric and hybrid cars. And the benefits of State Farm don't stop there! When hazards get in your way, you can be sure to receive personalized straightforward care from State Farm agent Jason Oyler. Reach out to Jason Oyler's office today!

Have More Questions About Auto Insurance?

Call Jason at (801) 546-6108 or visit our FAQ page.

Simple Insights®

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.

Jason Oyler

State Farm® Insurance AgentSimple Insights®

What is first party medical and PIP coverage?

What is first party medical and PIP coverage?

Personal Injury Protection (PIP) pays the reasonable and necessary medical expenses you and your passengers incur after an accident, regardless of fault.

Medical Payments vs liability coverage: What’s the difference?

Medical Payments vs liability coverage: What’s the difference?

What's the difference between Med Pay and liability auto insurance? Learn who's covered, when they pay and which is required vs. optional.